What is a Credit Limit?

The credit limit is the amount limitation bar provided by your credit card issuer, until which you are allowed to borrow money from them. The limit bar is set by the lender on the basis of various factors such as your yearly income which determines your ability to pay, credit utilization, payback history, etc.

What is Credit Limit Decrease?

The limit decrease occurs usually when lenders are not ready to take economical risks, hence they analyze the client’s capability on various factors before lending them money. Limit decrease usually occurs due to delayed payments, high or low credit card utilization, changes in buying behaviour.

Why is Credit Limit Decrease important?

The limit decrease will save the lender from monetary downfall. Lenders make the limit decrease often by analyzing the client’s credit reports and scores. Therefore timely reviews on customer’s credit history will eliminate financial risks.

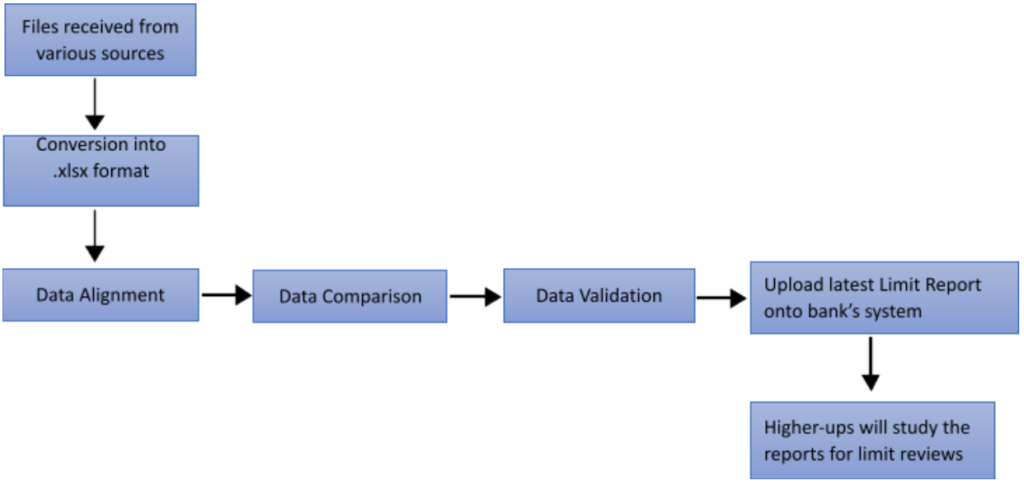

Steps used in executing the process manually:

1. Data collation: The information such as credit history data, current balance and specific card issued along with their relative limits allocated is received from various sources and combined together for further calculation.

2. Data computation: Checks and validations are applied as per the company’s predefined limit policies and the latest limit values are provided.

3. Latest limit upload: Currently approved limit values for all users are stored and updated in the bank system for the bank’s review.

Problems with Manual process

Errors are obvious when a process involves manual intervention. Following are some of the notable problems with the manual process:

1. Data discrepancies: Exact figures are required for bank reviews, errors in numbers will surely mislead interpretation.

2. Heavy data volume: Processing time is directly proportional to the amount of data. More the data, more the consumption.

3. Varied dataset: Data from different sources do not follow a specific structure. Data structuring takes time and effort.

Benefits of Automation

1. Automated Credit Limit Decrease process got rid of all the difficulties faced by the bank, also making it resource-free, error-free, and faster.

2. Huge amount of data can be stored in the database and the latest data can be retrieved when required.

3. Personalized solutions were provided leading to data interpretation cut-off from the bank’s end.

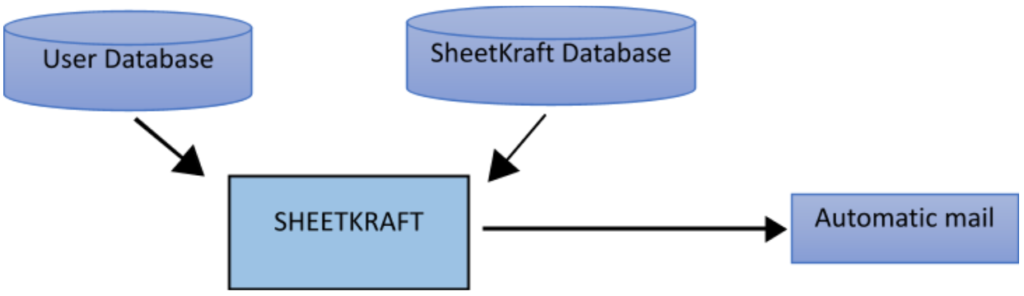

How did SheetKraft help with automation?

The customized application was built satisfying the much-required automation as well many other features. One of those was graph reports of each customer showcasing their usage history of credit cards. These reports were auto-mailed to the senior management, which was used for a better view as compared to figurative data outputs produced via a manual process.

Before SheetKraft

After SheetKraft

Book A DemoOverall time spent on completing the whole process through automation takes only 7-10 minutes whereas the manual process was taking around 3 hours